Nigeria OML95

Akata Energy are seeking investment in OML95 in shallow water Nigeria.

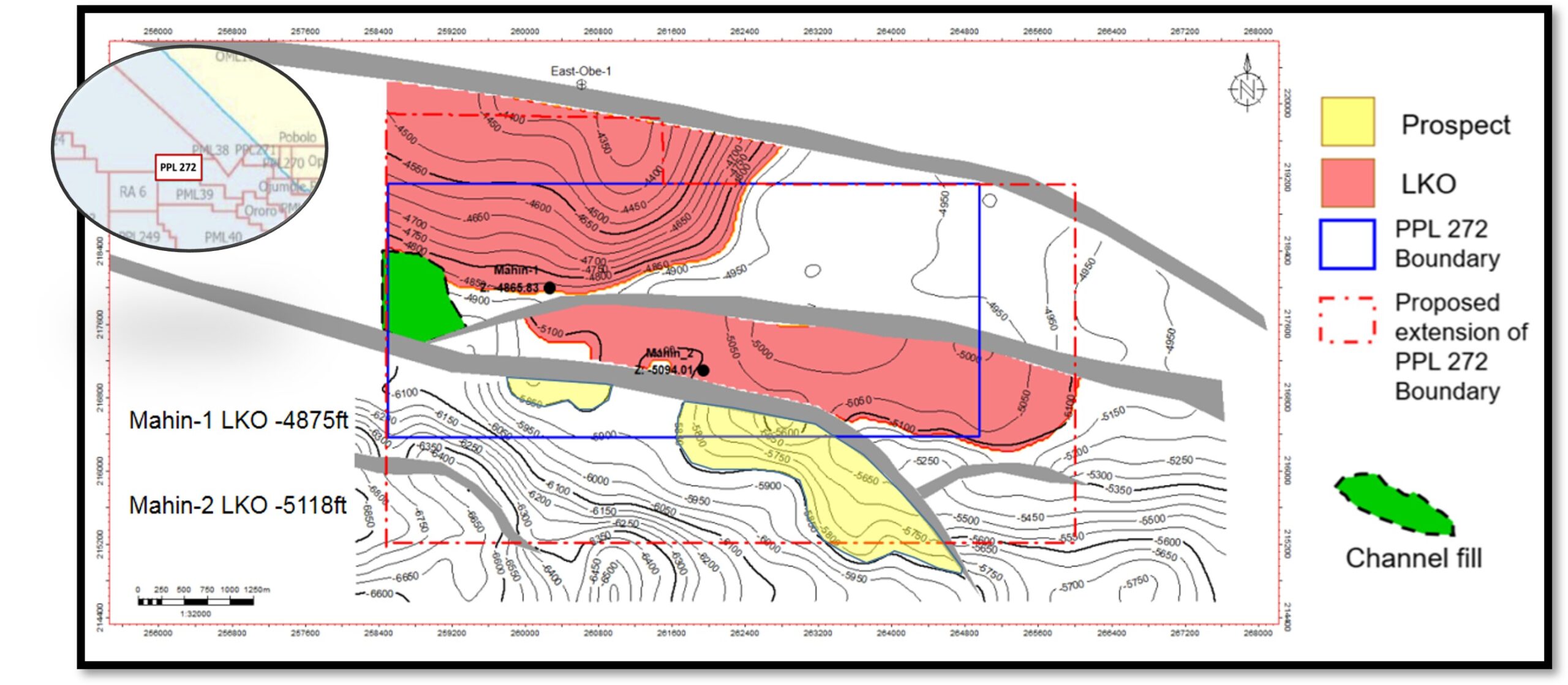

Mahin-1 was drilled to 9,540.6 ft in 1968 and encountered nine hydrocarbon sands. Mahin-2 was drilled in 1986 to assess the downthrown fault compartments and encountered several hydrocarbon sands. RFT was performed on four sand levels at different depths, which yielded varying results and was suspended; no DSTs were performed.

Preliminary evaluation indicates Mahin Field’s producible proven reserves estimate of 22.11 MMBO with significant upside potential.

The notional field development plan includes side-tracking the existing Mahin 2 Well to an optimal location, and drilling three new Wells.

Mahin 2ST, 3 and 4 are planned to be completed as dual strings with sliding sleeves to target the shallower Reservoir sand, while 5H is planned as a horizontal Well in the A3 sand.